We believe that this article was useful for you, and now you know exactly how to create innovative financial solutions. Creating a superior fintech app will bring the financial system closer to perfection. Some markets still lack suitable and reliable fintech applications, so you have a good opportunity to develop such a solution and attract investors. Given the rapid digitization of the world and the rapid increase in the number of financial applications, you should start developing fintech applications and start innovating faster than your competitors. Many companies have already implemented fintech solutions into their workflows to increase competitiveness and cost efficiency. Undoubtedly, there are many complexities in the process of fintech application development, but by entrusting the creation of a product to a reliable development company, all these complexities will be promptly resolved. Our software development company is ready to bring your unique idea to life and help you to develop an enterprise-class fintech application, which will surely meet your clients' needs.

Fintech Industry Overview

Many financial companies actively use fintech applications, and some even create their own. The growth in the number of fintech startups is accelerating every year. Many businesses have realized that the decision to create a mobile banking app will have a positive impact on customer retention. Hundreds of mobile financial transaction and data processing solutions are created every month. Fintech can already be called a dominant trend in the financial world, many companies have achieved significant success, and fintech itself has become an important link in the financial services chain 😏. Fintech is needed to create a corporation's own loyalty system and allow customers to make payments with a fixed benefit, winning their favor. If you decide to build a fintech app, remember that communication between the support team and users must be convenient. Thanks to fintech tools, online applications have a modern, user-friendly interface.

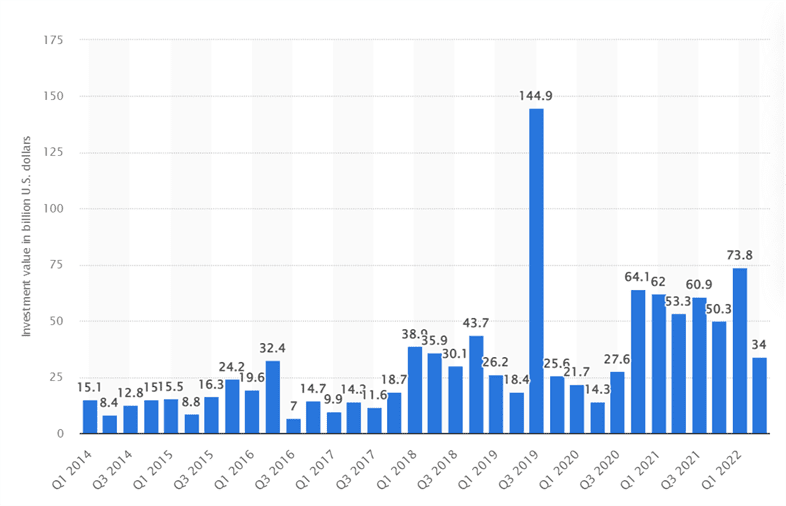

Source: Statista

As you can see from the statistics on the volume of investment in fintech all over the world from Q1 2014 to Q2 2022, fintech is a promising and growing technology. There is a strong need for fintech applications among users of different ages, locations, and social characteristics. Therefore, if you decide to create a fintech app, your business will be more successful. The demand for mobile fintech apps will only grow over the years, and after a while they will completely replace outdated financial management solutions. Today, fintech companies are separating all types of transactions that were traditionally performed by financial institutions and focusing on niche financial services, making them as simple and user-friendly as possible. Many companies have long made sure to make a mobile banking app, and now they are more competitive than those who have not yet done so. Fintech is now used for a range of financial practices, such as money transfers, depositing checks via mobile banking, bypassing the bank to apply for a loan, dealing with your savings, or raising money for a startup. And it's all without human assistance.

What is Fintech, and How Does it Work?

Before you can develop a fintech app, you need to understand the basics. Fintech is the technology with which businesses and financial services manage the financial aspects of business. Companies use fintech to compete with traditional financial institutions for customer funds. Fintech has come very close to the consumer of financial services over the past decade, this is because it is at the core of online transactions. Before you start to make a fintech app, remember that consumers want easy access to financial services, free payments and fast loan approvals, Fintech helps consumers solve their needs and problems quickly and with minimal effort. Fintech apps and neobanks are already firmly established in the financial system, and are having a significant impact on traditional financial institutions.

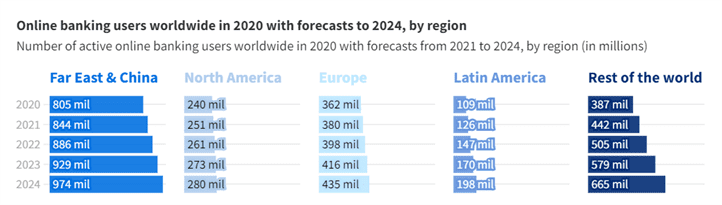

Source: Finder

Neobanks, i.e., online banks that operate without physical branches, are in great demand around the world. They optimize many processes: paperwork, staff work, collection, storage of money, data processing, so they can offer clients more favorable conditions. According to statistics, the use of online banking will grow worldwide in the upcoming years. The largest market is Asia, which is predicted to have nearly 1 billion active online banking consumers by 2024. So, now is a good time to start a mobile banking app.

Fintech closes the analytics segment, allowing the right data to be collected and audited. It introduces a set of anti-fraud measures aimed against fraud in banking or Internet transactions. Developments in fintech projects allow us to process more data about the customer, such as where and how they pay with their card. Then, based on this, banks can offer users interesting perks and other rewards. To successfully develop an online banking application, you need to take care of a good data protection.

Every year we see more and more fintech startups that make products related to the collection, analysis, and big data processing. This may be information about consumer preferences, search queries, the geography of payments, etc. Big data processing helps personalize offerings, tailoring them to market demands and customer categories.

Types of Fintech Companies

- Digital Banking Apps

Mobile banking is a large category of fintech apps that are designed to provide users with money transfer and savings options. Many businesses have decided to build a mobile banking application to improve user retention. Mobile fintech apps have eliminated the need for consumers to visit a bank branch. Users can now easily perform all of their banking transactions through a mobile app. Neobanks are outpacing the traditional banking system, with the number of users growing every year. Consumers using the fintech applications in banking can quickly and easily access their personal accounts at any time. Users are excited about Neobanks services as they provide convenient and fast banking services.

- Insurance Apps

The insurance technology industry has been growing lately, and many companies have already created mobile insurance apps. Convenient mobile apps make it easier for consumers to submit applications, calculate premiums, search for insurance claims, process payments, purchase insurance and more.

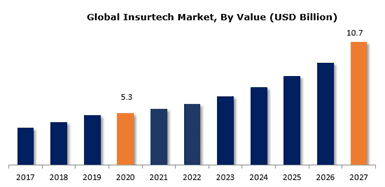

Source: GlobeNewswire

According to the study, the global insurtech market will grow at a CAGR of 10.6% (2021-2027), generating about $10.7 billion in revenue by the end of 2027. This market growth is driven by a gradual increase in life insurance coverage and an increase in the number of different insurance claims.

- Budgeting and Financial Planning Apps

The popularity of budgeting and financial planning apps among users is gradually growing. Using these apps, consumers have effective control over their finances. The apps connect to customers' bank accounts, allowing them to effectively track and manage their budgets. Financial management features are varied and can include goal setting, various financial tips, and income forecasting. Using such apps, users can better control expenses and allocate budgets.

- Cryptocurrency Apps

Fintech and cryptocurrency are closely linked. Cryptocurrency apps give users access to investment opportunities by providing mobile wallets for storing assets, features for tracking cryptocurrency markets and investing in cryptocurrency. Using cryptocurrency apps, consumers can buy, sell and store cryptocurrencies. The popularity of cryptocurrency financial apps is growing daily at a high rate.

- Lending Apps

Lending applications allow customers to bypass the barriers associated with obtaining loans from conventional lenders. The goal of such apps is to connect those who need money with those who can lend them the money. With P2P lending, it becomes possible to connect borrowers with individual lenders. Lending apps provide borrowers with completely free access to financing. Thanks to loan apps, users can borrow money without involving a lending institution and lengthy negotiations.

- Investment Applications

Investing using mobile devices is becoming very popular, and the number of investment app downloads is enormous. Such apps provide consumers with increased access to stock markets and the ability to take a closer look at investment portfolios. Consumers use investment apps to trade cryptocurrency, stocks, and mutual funds. Moreover, these fintech applications provide users with a news feed and analytics that can be used to make an informed investment decision.

Best Fintech and Mobile Banking Apps

The fintech ecosystem is constantly evolving, with new applications, services, and technologies attracting users' attention every month. Mobility has had a significant impact on human life and business, the financial industry is no exception. Fintech apps are making digital payments easier and more reliable than ever before. In this section, we highlight well-established, robust applications in the Fintech ecosystem that meet consumer needs, provide users with quality online banking services, and are widely used around the world.

MoneyLion

This fintech app will appeal to consumers who require credit enhancement, effective financial management and financial advice. Consumers can turn to MoneyLion for any help related to finances, as the app is a mix of credit, savings, and wealth management. The app operates on a subscription-based model, offering customers account creation and a variety of financial services, from counseling to investing.

MoneyLion shared record results for Q2 2022 showing a 131% year-over-year increase in quarterly revenue, new customer additions, about 950,000 registrations, and a 124% year-over-year increase in total customers to 4.9 million.

Many consumers prefer MoneyLion because of its simple interface and advanced wealth management aspects. Users have access to instant money transfers with no fees. Customers also enjoy additional features such as push notifications, credit score checks, cashback, and more.

Robinhood

This free fintech app is designed to trade stocks, indices, and even cryptocurrencies with zero fees. The app has integration with more than 3,500 banks in the US. The investment platform is easy to use, even a novice trader can easily figure out how to use it and trade. The app works on a freemium model, providing basic services and features for free and charging for advanced features.

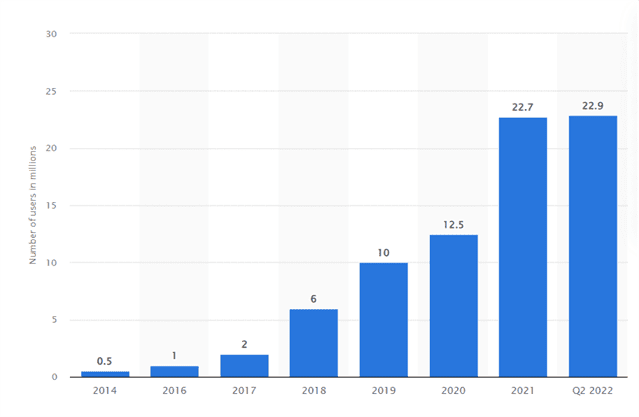

Source: Statista

As you can see from the statistics, for 8 years the number of users of this fintech application has grown incredibly. It is not surprising because Robinhood is ideal both for beginner investors with little experience in fintech, and for experts. Also in this application, users can exchange cryptocurrencies for free and invest directly in IPOs.

Chime

Chime allows consumers to effectively manage their spending and savings, as well as charging zero fees for transactions and ATM withdrawals 😋. The app allows users to automatically save by transferring 10% of the transaction amount to a savings account.

App users can quickly and easily manage a checking account, savings account and credit card, all of which are protected from hacking by a high-level security system. If you do not use traditional bank services and want to bank without fees using a user-friendly app, Chime is one of the best options on the market.

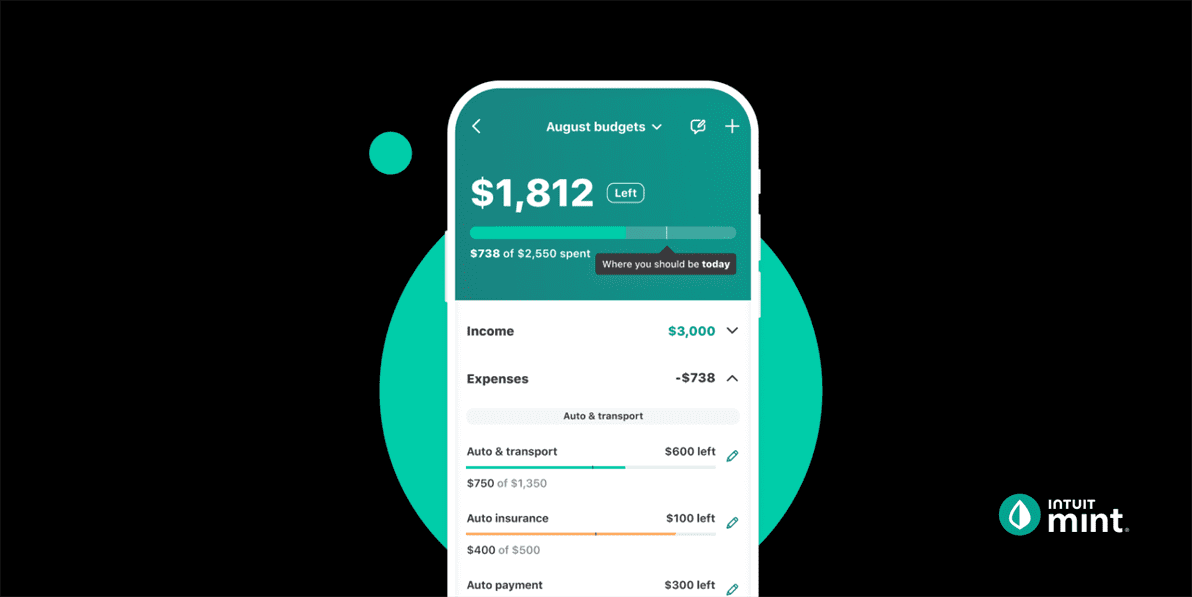

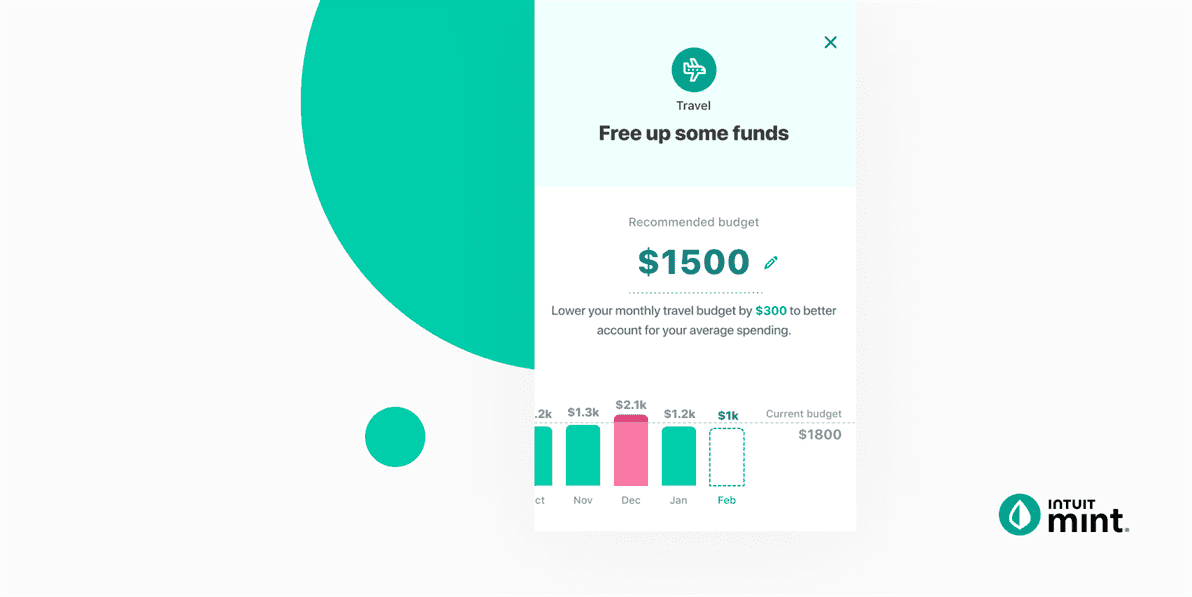

Mint

Mint is one of the most popular free budgeting applications. This fintech app allows consumers to keep all their financial accounts in one place, track transactions, expenses, savings, receive monthly bills, pay bills and set budget goals. The app has a variety of notifications, for example, about upcoming spending.

Using the app's built-in statistics and tips, users can analyze their spending and get valuable advice on how to improve their finances and save on expenses. The app also has a strong encryption system to ensure the protection of consumer personal data and personal accounts. Mint has no competition among free budgeting apps, and it's suitable for both beginners and professionals.

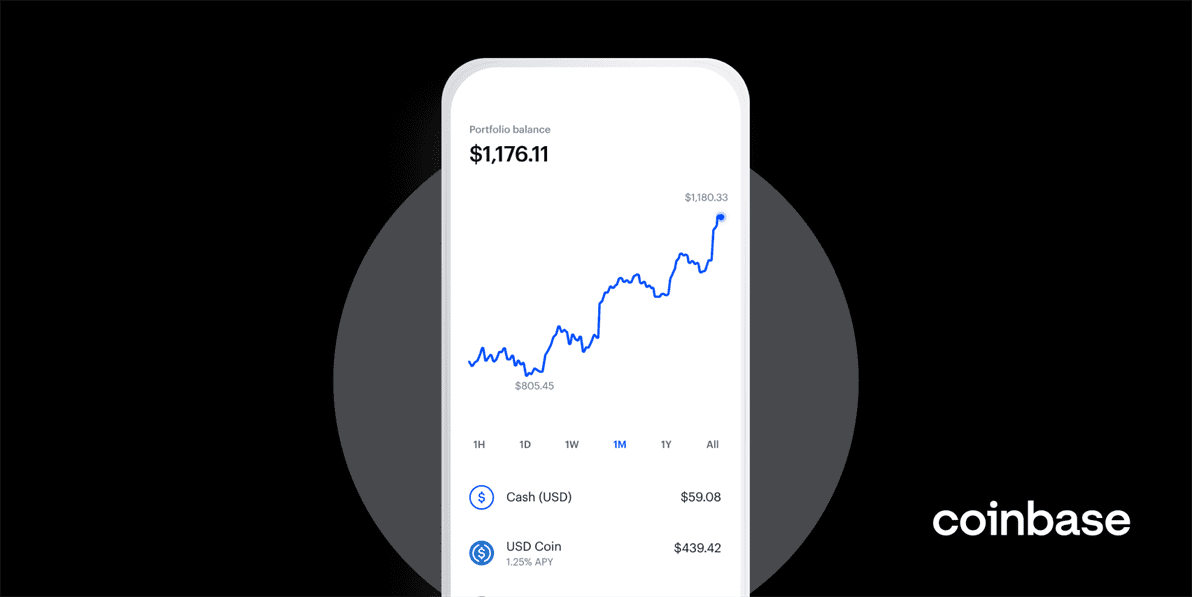

Coinbase

Coinbase allows consumers to enter the world of blockchain and cryptocurrencies. Users of the app can trade digital currencies, cryptocurrency, and store assets in a personal account. More than 98 million users from 100 countries trust the app, which is not surprising given its versatility and reliability. The app is easy to use and easy to navigate for both novice cryptocurrency traders and experts.

Coinbase is the largest cryptocurrency exchange with a high level of security. Consumer assets are protected by unique security protocols, two-factor authentication and multi-signature security features. The app allows users to make instant transactions between themselves in real time.

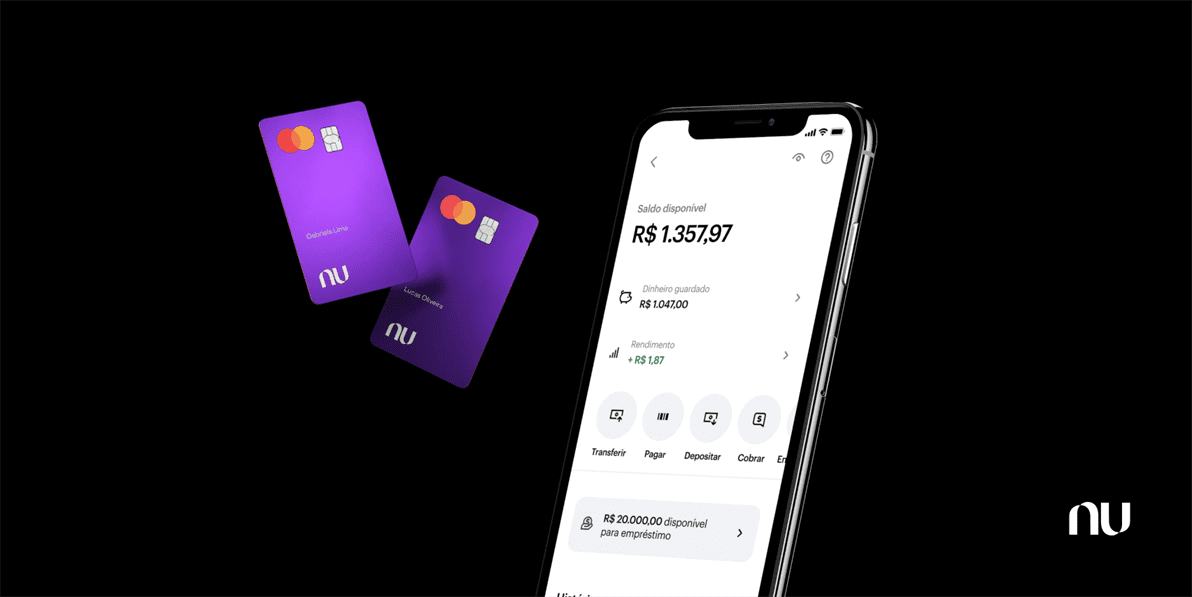

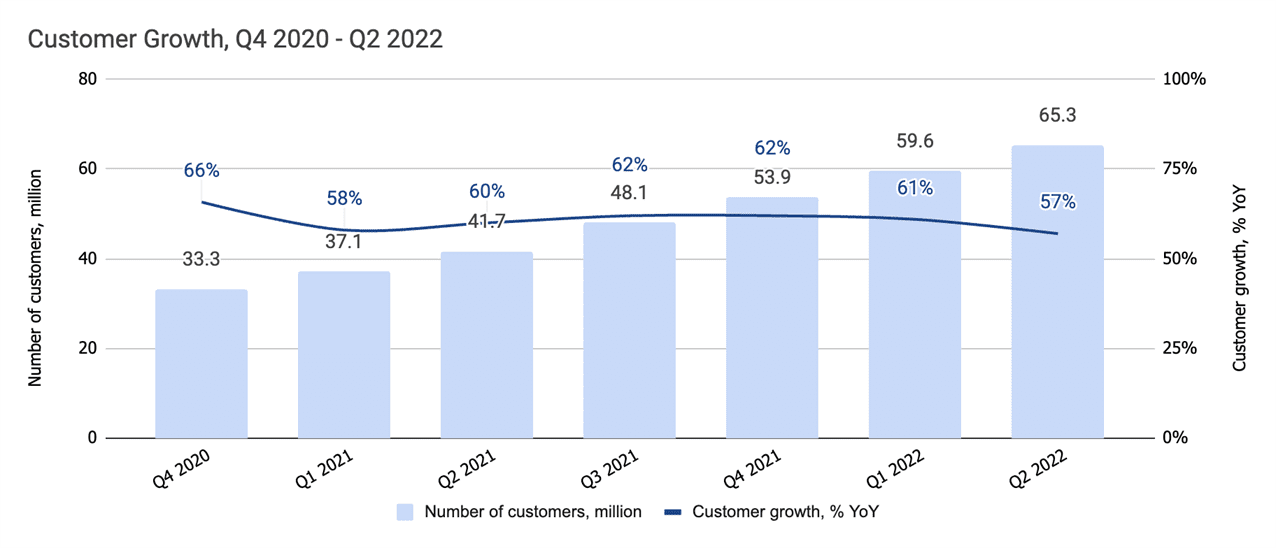

Nubank

Nubank is the world's largest online bank by customer base. Nubank added 5.7 million customers in the second quarter of 2022, and finished the quarter with 65.3 million customers. Users of this mobile app for banking can use credit cards, business accounts, and personal accounts, as well as make free instant money transfers.

Source: Popular Fintech

Nubank cares about providing a high-quality user experience, so the application is designed with a simple user interface and convenient navigation so that even newcomers can easily understand it. Nubank's business model is based on creating a broad ecosystem of various useful services that it offers its customers on a single platform.

How to Create Fintech and Banking Apps?

In this section, we have prepared the basic steps for developing a competitive fintech mobile application that can meet the needs of the most demanding customers. Developing any financial platform requires an experienced team of programmers, analysts, designers, and engineers who, with a thoughtful approach, will be able to carefully implement your idea. With your money and reputation at stake, it's important to plan the project carefully and be aware of all the pitfalls. Let's take a closer look at the basic steps of fintech and banking app development.

Choose a Niche

To begin with, you need to decide on the niche in which the software will be used. You need to analyze and define your target audience, and study the direct competitors in the market relating to the financial application.

Find your niche in the market, analyze existing solutions to create a unique, useful and advanced solution for users. Research market needs, especially in countries where good fintech and banking solutions are lacking, to increase the chances of success.

Ensure Legal Requirements

You need to think seriously about the legality of your financial application. Each country has its legal and regulatory requirements in the financial sector, so your app must comply with privacy laws and other legal regulations. In addition, your application must comply with various financial standards that differ from country to country, such as KYC, PCI DSS, AML, and others.

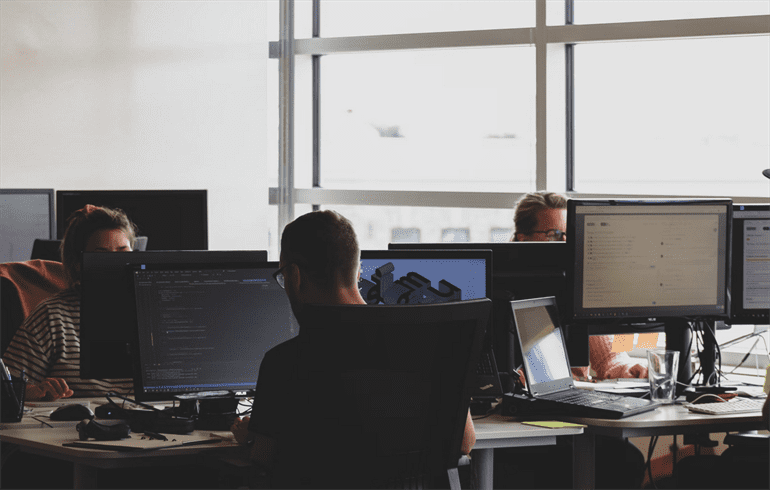

Hire a Dedicated Financial App Development Team

After defining the idea and goals of a financial application, you will need specialists to develop it. There are different models of cooperation, you will need to choose one of them, depending on your goals and the complexity of the project implementation.

For a complex and large-scale project, it is better to assemble an in-house team, and for simpler ones, choose outsourcing or freelancers. When researching companies or individual developers, carefully examine their portfolios and reviews.

Define Your App?s Features

Your development team should consider and identify the banking mobile app features that need to be added to make your financial application work effectively. Start defining the most important features and add them to your minimum viable product. Then, as required, you can add other, more advanced features.

Choose a Technology Stack

There are many technologies and programming languages for developing fintech and banking applications. The technology stack will depend on what type of financial application you select: native application, cross-platform application, or hybrid application. If your team consists of experienced developers, or if you have hired an outsourced software development team, they will advise you and help to choose the right technology stack.

If you are developing an Android app, it will be developed in Java or Kotlin. An iOS mobile app will be developed using Apple XCode, Objective-C, and Swift. Developers most often use React Native and C# to create cross-platform apps. Various frameworks are used to create hybrid apps: React Native, Flutter, Ionic, Xamarin, and others.

Think of a Superior UX/UI Design

Your designers should start building mobile banking apps for fintech with an attractive visual design. A UI/UX study should be conducted to work out the navigation of the app and a user-friendly interface. The interface of the financial app should be intuitive, user-centric, and pleasing to the eye. You have to make sure that all the functions the user needs are intuitively accessible on the dashboard.

Develop Your App

After designing the financial app, your developers should move on to implementing the technical part of the project. In addition to communicating with the developers, you will work with QA experts who will test the application and advise on what can be changed and improved. The result will be a minimally viable product with basic fintech app features and components. This is enough to obtain feedback from users and also to attract investors.

Test Your App

Before a financial application is released to the market, it should be thoroughly tested to make sure it is error-free. The app must work properly, and the QA team needs to fix any problems and vulnerabilities as quickly as possible to do so. Your experts can use both manual and automated testing to check the application for errors.

Launch Your App

After successfully testing the financial app and fixing bugs, you have to release it to the market. After releasing the app, your team must make sure that users are happy with the solution and its features. You need to review user feedback regularly and make necessary improvements to the product. For fintech and banking applications to be competitive and evolve, they must be constantly updated and improved.

Fintech and Banking Mobile App Features

App features that can make it easier to use and help users in various ways play a considerable role in the success of customer retention. If you want to succeed and get good results, you should know about the main features that will help with customer retention. By implementing advanced features in your app, you will achieve increased user retention, increase company loyalty and increase the number of app installs. As consumer needs grow, it's important to consider adaptable features to increase customer retention. We have prepared must have features for you to ensure the best user experience.

Biometric Security

To protect consumers' money, your financial application must be highly secure or no one will use it. To achieve a high level of application security against unauthorized access, we recommend that you integrate biometric authentication into your solution. The most suitable options for biometric protection are fingerprint access, or facial recognition. It is impossible to reproduce a user's face and fingerprints on the Internet, so hackers won't be able to steal anyone's money. Furthermore, biometric authentication, in addition to the high level of security, is convenient and fast.

The Nubank mobile app has introduced biometric protection, which is designed to protect users from hacking and combat credit card fraud. The app's biometric protection includes FaceID and VoiceID features. Through the use of an advanced biometric security system, Nubank users can be sure of keeping their funds and personal account data completely safe.

Gamification

Gamification is an interesting feature that includes game elements and reward systems that aim to make using the app fun. Thanks to this, you can not only retain customers, but also attract new ones. Gamification includes many elements, such as badges, leaderboards, points, completing tasks to earn rewards, setting goals, and tracking progress.

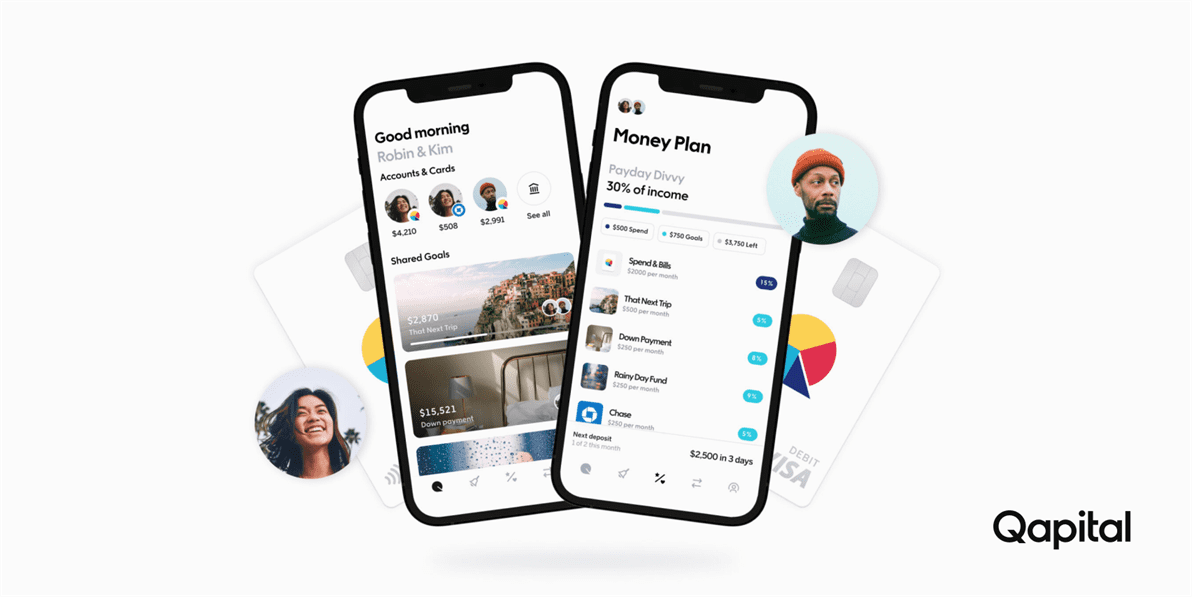

One of the exciting gamification techniques is the goals and objectives feature. This feature will increase consumer satisfaction and allow them to improve their financial well-being. To increase consumer interest, the option to set savings goals and be rewarded for achieving them can be added to the app. The Qapital financial app gives users the ability to set savings, spending, and investment goals. Qapital also has visualization functionality.

Source: qapital.com

Data Visualization

Users of your fintech app should receive detailed charts and visualizations of all financial-related information, with the ability to select a specific period of time. The app should present users with financial data in an interactive way, expenses, income, investments, and so on. Visualization is undeniably important to ensure user experience and consumer retention.

It is an undeniable fact that users absorb information better in graphical form and can track trends and patterns more easily. In the Mint app, for example, users see their bank balances in a chart and can easily analyze their income and expenses. When providing data visualization, developers must optimize it for smartphone screens by selecting the right layout, colors, and fonts.

Source: Mint

Cashback

The cashback feature allows users to receive a percentage of the money they spend. Cashback is no longer just a nice bonus, but an obligatory feature of any successful fintech banking apps 💡. Consumers like apps in which they can benefit from any transactions they make. This feature is most often used by neobanks. This is pure psychology, if consumers see that they can profit and save their money, it will be a definite advantage for them, and the chance that they will use the app will increase. Cashback increases user interest and retention rates for your banking and finance app.

MoneyLion offers customers a lucrative rewards program. Users of the app receive cashback for purchases of groceries, daily necessities, prescriptions, and so on. When users make a purchase in the rewards tab of the mobile app using their MoneyLion debit card, they earn points, which are then redeemed for cashback into an investment account.

Chatbots

Chatbot is a great feature with which you can improve the user experience of your app. AI-driven chatbots provide 24/7 instant support to consumers, answering thousands of questions at a time. The best fintech apps have embedded chatbots into their apps to assist users with personal finance and other issues.

For example, Robinhood has implemented a chatbot in its trading & investing app that helps automate many processes and improves the user experience. The chatbot saves time for employees to solve various issues, as well as speeds up user interaction with the application.

Two-Factor Authentication

Two-factor authentication is used to protect the personal data of fintech application users and make it harder for hackers to break in. In today's world, cracking a simple and short password, which most people use because it is easy to remember, is not very difficult. With two-factor authentication, even if a hacker passes the first layer of protection, he will have to get access to a phone number or email, which is much harder.

Chime requires app users to set up two-factor authentication, to securely protect your account from intruders. Two-factor protection is not a panacea for hijacking a financial account, but it is a reliable enough barrier that seriously complicates attackers' access to application user data and to some extent eliminates the shortcomings of classic password protection.

Conclusions

Popular in blog

View allWe’ll contact you within a couple of hours to schedule a meeting to discuss your goals.

- PROJECT INQUIRIES info@artjoker.net

- CALL US +1 213 423 05 84

contact us: