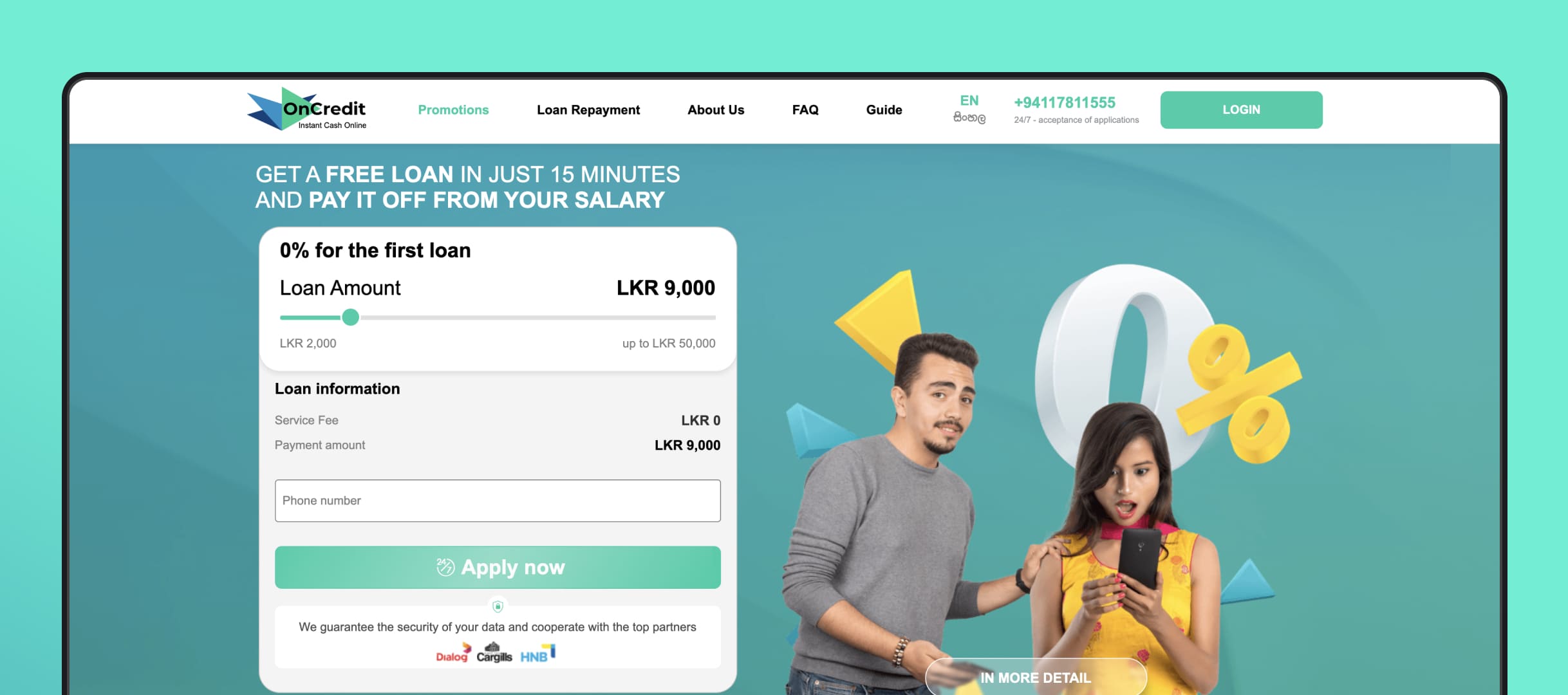

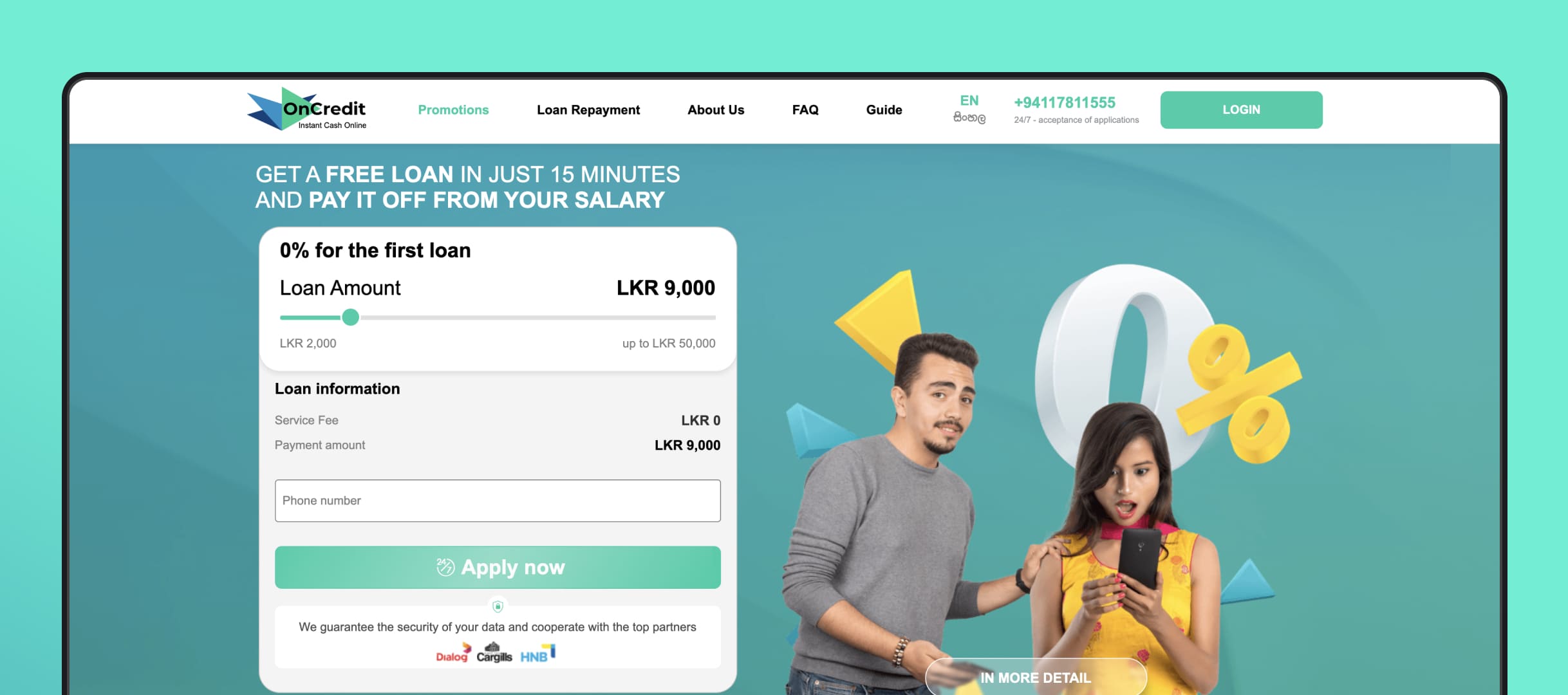

OnCredit is an online credit service in Vietnam. Micro financing market is the rise and this project was a challenging assignment built to scale for future high load with multiple integration points to external applications

Business challenges

Our customer had approached us to develop software for a new microfinance company.

Our tasks were:

- Develop the process of online loan application and issuance;

- Develop the process of lender verification;

- Enable users to apply for loans;

- Allow users to track the status of their current loan;

- Allow users to repay/extend loans online;

- Allow users to link their card to receive a loan;

- Implement the process of informing customers about the current state of their loan;

- Ensure secure storage of user data;

- Allow administrators to track the status of loans;

- Implement the process of signing a loan agreement online;

- Implement daily interest accrual on issued loans;

- Allow administrators to configure credit products (for first-time users, for constant users);

- Allow administrators to track the credit history of lenders;

- Allow administrators to manage overdue loans;

- Ensure uninterrupted system operation with large volumes of data.

Key results

- Integrated UBKI API for obtaining customer credit history;

- Integrated Scorista.ua API for obtaining borrower scores;

- Developed a system of business rules for initial lender qualification;

- Developed a queue system for launching scheduled operations for interest accruals on loans, changing loan statuses;

- Developed a process for signing loan agreements using SMS;

- Created an administrative panel with a multi-level access system;

- Developed a messaging system (SMS / Email);

- Integrated a payment service;

- Integrated CPA networks;

- Created a loan application process;

- Developed and implemented a loan calculator;

- Created a customer's personal account that enables users to view the history of issued loans, view the current loan status, link a credit card, repay a loan online, extend a loan online, sign a loan agreement;

- Created an automated process for debiting customers' cards for debt;

- Developed an automated process for collecting overdue debts (debt collection);

- Developed automated processes for microcredit management, such as: loan extension, partial or full repayment; calculation of interest, penalties, and fines on loans; transfer of loan amounts to customers' bank cards; manual and automatic approval of loan applications;

- Developed a system for creating reports of various types ( Accountant, Working with CPA networks, Report on issued and overdue loans, Report on customers, Daily Report).

Our Solution

The system has been deployed on AWS connecting the below services:

- Load balancer;

- EC2 Instance;

- Auto Scaling group;

- S3 Bucket;

- RDS;

- Redis;

The below integration were made:

- SMS/email services: esputnik;Payment services: Fondy, Wayforpay;

- Integrations with CPA networks: Admitad, SalesDoubler;

- Integrations with external scoring services: Scorista.ua, RiskTools;

- Integrations with services for obtaining users' credit history: UBKI, MBKI;

- Integration with an anti-fraud system: fingerprint.

Our achievements

- The designed architecture on AWS allowed to handle big loads on the service and provided a high level of fault tolerance;

- The developed system allowed for faster scaling and integration of additional services. (For example, additional CPA networks);

- Thanks to the automation of processes, we were able to reduce the time for reviewing a credit application to 15 minutes.

- As a result the developed solution enabled our customer to perform the full cycle of lending money online without any traditional banking