IT Financial Consulting Services

Digital transformation consulting

Our financial services consulting firm helps enterprises increase the value and efficiency of their business through innovative technology. Many financial firms want to get their products and services to market faster with minimal risk, so they turn to us for consulting. We help clients understand how processes, technology, and people affect business results. By mastering the holistic approach, organizations can successfully rethink existing business processes and withstand technological disruptions.

IT strategy consulting

We analyze various aspects of your financial businesses, such as management and economic efficiency. After the analysis, we develop a strategic plan based on the goals of your organization. We perform research on your company's IT environment to determine how to improve its financial situation. With our professional financial consulting services and solutions, companies can better align with their business goals and improve the scalability of their IT infrastructure. Our experts conduct a comprehensive analysis of your idea, project, or application and help you identify its strengths and weaknesses.

IT assessment

We evaluate your existing software for operability and compliance with the requirements. Based on the stability and profitability of the project, we provide the client with forecasts and recommendations to improve its performance. To conduct an IT assessment of your financial system, the financial experts and analysts at our fintech consulting firm carefully analyze income statements, expense reports, balance sheets, cash flow statements and more. Our experts will help you to identify financial problems within the work process of your financial solution, so you can change the situation and increase its productivity, efficiency, and transparency.

IT operations consulting

We provide clients with IT operations consulting to improve the efficiency of business processes and management systems. Our financial specialists have in-depth experience in IT operations consulting and offer specific solutions to solve various financial problems of our clients. During the analysis process, our financial specialists use advanced research, metrics and state-of-the-art methods to optimize your company's business processes. To improve your application's performance and profitability, our financial advisors will help you understand the issues that should be eliminated.

IT project and program management

We provide IT project and program management services that help financial enterprises achieve their goals. During the work process we use agile methodology, waterfall methodology, or a combination of these two methods, depending on the tasks. Based on your strategic goals and resource availability, we carefully prioritize the steps necessary for your business success. We specialize in IT project and program management for large and complex initiatives, so we are always ready to assist you in determining effective options for project implementation.

Technology consulting

By leveraging our technology consulting practice, companies can create robust architectures and implement innovative technologies into their business processes. With our technology strategy and finance consulting services, financial organizations leverage modern technology to drive successful digital transformation. Moreover, our technology team leverages deep subject matter expertise and industry expertise to provide cutting-edge technology consulting services that will ensure the digital excellence of your financial business.

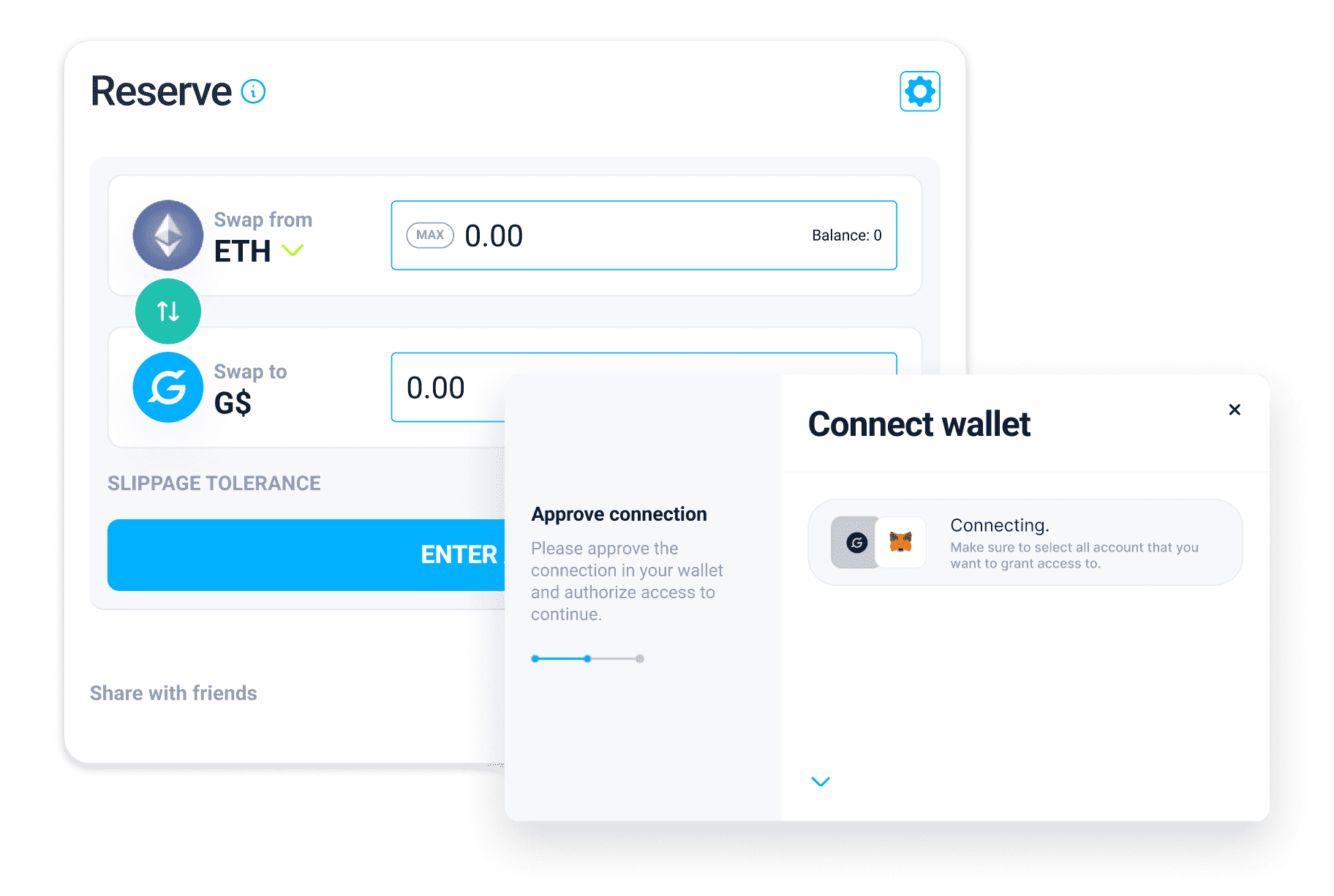

Application implementation

By taking advantage of our automation, modeling, and production management solutions, the operational activities of your financial organization will improve. Our experts are ready to help with all aspects of your application implementation: software installation, application configuration and system architecture. While implementing applications, our primary goal is to achieve full alignment with your company's business goals and processes. Using a combination of advanced technology and standardized processes, we accelerate the implementation of your business-critical applications.

Application modernization

In today's digital age, application modernization is critical, so organizations must rebuild their legacy applications to keep up with new trends. We make financial enterprises more efficient and modern by updating legacy applications without disrupting their functionality and uninterrupted performance. By entrusting the integration of new functionality to your legacy applications, you can bring the latest features of IT to your business. Methods of modernizing an application include re-hosting, re-architecting, re-platforming, re-coding, and re-engineering.

Application support

By taking advantage of our application support and maintenance services, you can increase customer satisfaction and improve the user experience of your financial applications, as well as speed up delayed projects. We will ensure reliability, high-availability, and alignment of the application with the ever-changing needs of your business. The support specialists at our digital finance consulting firm will ensure the smooth operation of your business-critical systems. We take all necessary measures to improve the performance of your business and protect applications from unplanned failures, as well as implement a disaster recovery system to avoid data loss.

IT infrastructure management

With our IT infrastructure management services, you can achieve impressive performance indicators in the global IT services market. We will provide your financial application with quality IT infrastructure management and quality fintech consulting services to achieve a significant competitive advantage for your solution over other financial solutions. We successfully provide highly sophisticated IT infrastructure management services and innovative solutions to achieve client satisfaction. Our talented professionals use state-of-the-art tools to manage the IT infrastructure of your project.

The Benefits Of Using Fintech Consulting Services

Competitive Edge

We provide fintech companies with technical consulting services to help them discover upcoming trends and resist competitors in the financial market. The fintech experts at ARTJOKER will help you minimize risks, identify ways to reduce costs, and optimize the entire performance of your project.

Competent Expertise

Because of the high level of competition in the finance sector, organizations need specific knowledge to be successful that they may not have. With our competent expertise, you will be able to provide prompt customer service and properly manage financial risk.

Impartial Perspective

Experienced specialists at our company help fintech companies make prompt financial decisions while developing financial solutions. We provide clients with an unbiased perspective and the right expertise to optimize their projects.

It's Easier to Make Strategic Decisions

It will be much easier for you to make long-term strategic decisions with the comprehensive help of our fintech experts. We will help you with consumer research, market analysis and strategic direction to facilitate strategic decision-making.

Our Fintech Consulting Process

- Analysis

At first, the specialists of our financial consulting agency conduct an in-depth analysis of your financial organization. Meticulous attention to detail and extensive industry experience help our specialists conduct a quality analysis of your company, as well as identify any shortcomings and their possible solutions. Our experts identify technology trends and customer needs that may affect the future positioning of the company. Moreover, we determine the position of your company in the market and compare it with your competitors on various factors, including market dominance, performance, innovativeness, etc.

- Strategy

We develop a strategy to take advantage of financial technology opportunities that will increase the efficiency of your financial product. Our experts develop strategies with which you can achieve long-term profitability with your financial solution. We leverage our profound experience in IT consulting for financial services and have a broad perspective with which we can provide our clients with a quality strategy that helps their projects achieve sustainable results. We use proven analytical methods and an individual approach for each client's unique application to improve its performance.

- Performance

We take a systematic approach when advising clients on performance issues of their solutions to ensure that their goals are met. Our experts will work out a performance improvement process for your product to eliminate any existing performance issues. Every digital finance consultant at our IT company will do everything possible to identify your project's performance issues, their causes, and identify options for solving them.

- Improvements

To succeed in the highly competitive financial market, you need to constantly improve the overall performance of your financial application. Our IT experts analyze the competitiveness of your financial solution and then develop measures to improve its quality and efficiency. We use state-of-the-art approaches to identify potential project improvement options. Our improvement suggestions will help you ensure that your product works efficiently.

At first, the specialists of our financial consulting agency conduct an in-depth analysis of your financial organization. Meticulous attention to detail and extensive industry experience help our specialists conduct a quality analysis of your company, as well as identify any shortcomings and their possible solutions. Our experts identify technology trends and customer needs that may affect the future positioning of the company. Moreover, we determine the position of your company in the market and compare it with your competitors on various factors, including market dominance, performance, innovativeness, etc.

We develop a strategy to take advantage of financial technology opportunities that will increase the efficiency of your financial product. Our experts develop strategies with which you can achieve long-term profitability with your financial solution. We leverage our profound experience in IT consulting for financial services and have a broad perspective with which we can provide our clients with a quality strategy that helps their projects achieve sustainable results. We use proven analytical methods and an individual approach for each client's unique application to improve its performance.

We take a systematic approach when advising clients on performance issues of their solutions to ensure that their goals are met. Our experts will work out a performance improvement process for your product to eliminate any existing performance issues. Every digital finance consultant at our IT company will do everything possible to identify your project's performance issues, their causes, and identify options for solving them.

To succeed in the highly competitive financial market, you need to constantly improve the overall performance of your financial application. Our IT experts analyze the competitiveness of your financial solution and then develop measures to improve its quality and efficiency. We use state-of-the-art approaches to identify potential project improvement options. Our improvement suggestions will help you ensure that your product works efficiently.

Learn about Artjoker expertise.

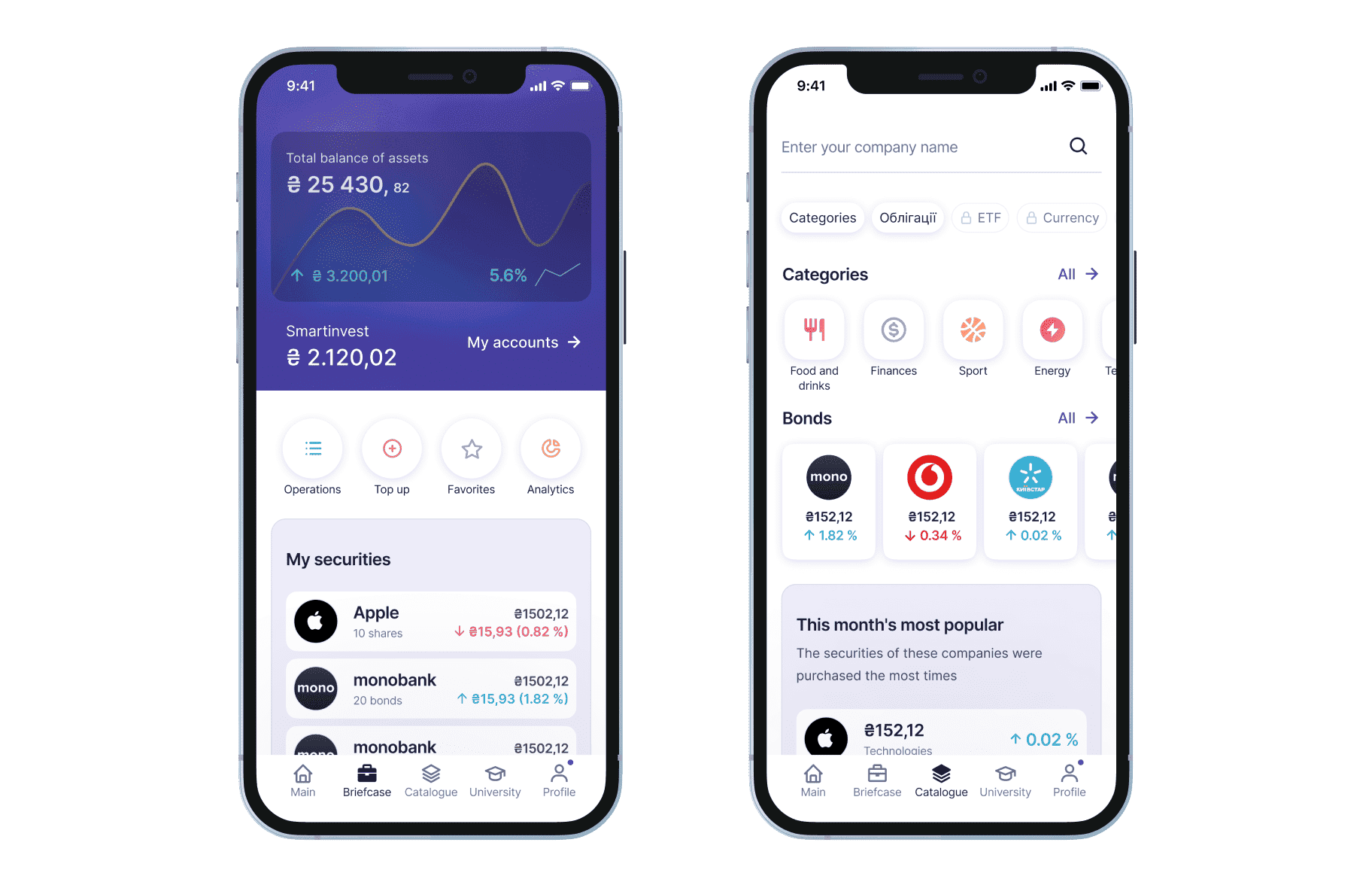

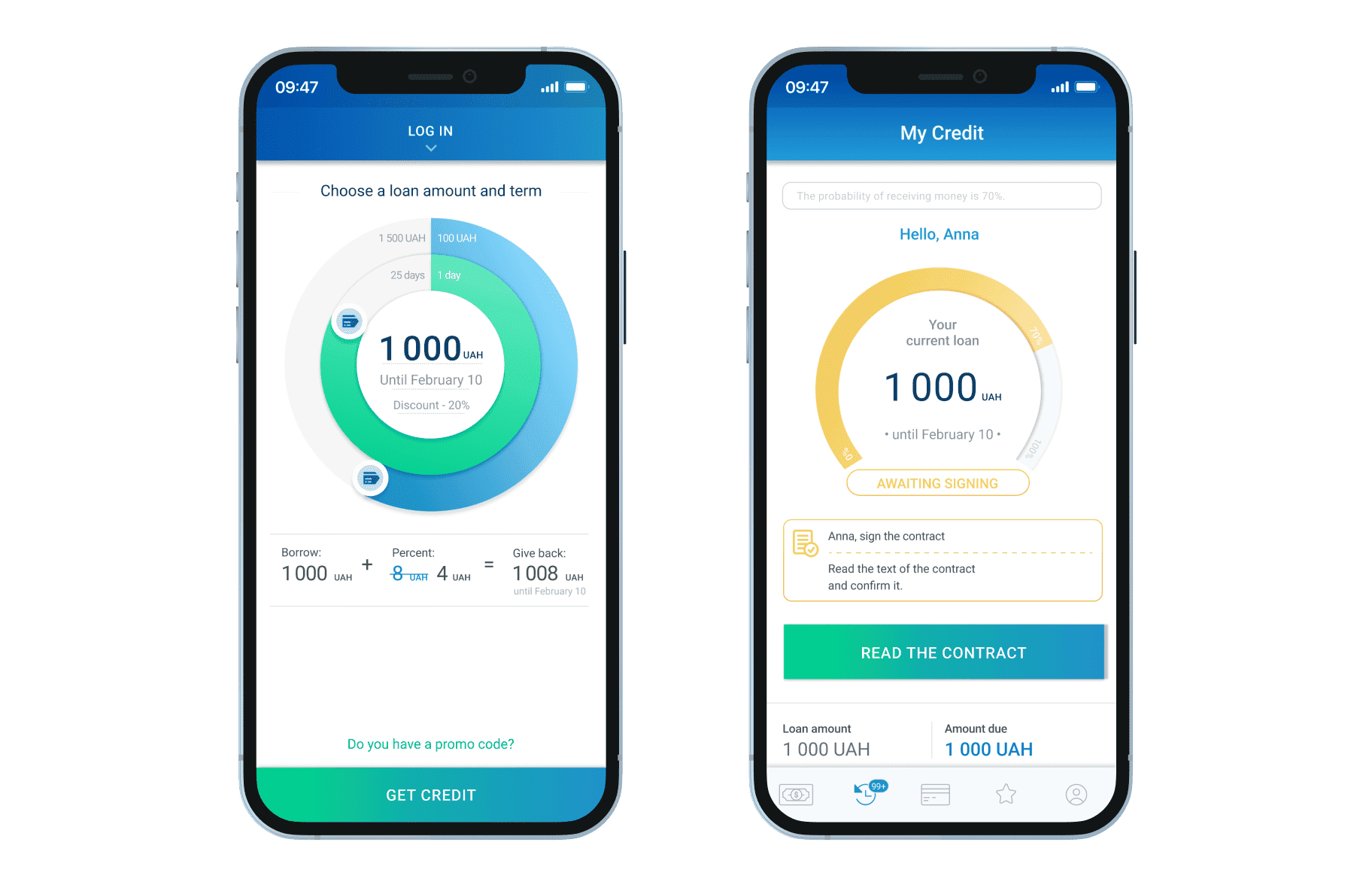

Our projects' details.

Hire a Fintech Consultant

Learn about Artjoker expertise.

Our projects' details.

Why Choose ARTJOKER Company for IT Consulting in Financial Services

An Objective Viewpoint

Our certified IT consultants use best practices to bring a fresh perspective into your technology environment and provide you with quality IT consulting services. We identify potential business related issues within your project and provide useful recommendations on upgrading or replacing outdated technology systems to improve the performance of your business processes.

Top Team

In our studio, we have a professional team of financial IT consultants that uses best practices to identify ways of improving the productivity and competitiveness of your organization. Talented consulting specialists from our company will provide you with recommendations that will help you achieve better productivity and greater efficiency for your enterprise. Our specialists will help you rethink your organizational structure and unlock revenue growth opportunities for your business.

Extensive Experience

With our extensive experience in fintech, we will help you to manage the complex business issues that are limiting growth, increasing expenses and creating risk for your organization. We have extensive experience in financial consulting, as well as in-depth knowledge of financial software development, so we will find any opportunity to make an improvement and help the growth of your business.

Expert Support

Our support agents have unparalleled experience in all sectors of financial services, and are ready to answer any question you may have as quickly as possible. We understand how important prompt technical support is to avoid slowdown in business growth, so we do not delay in answering your questions. So if you ever have a need for our remote IT financial consultant, he will always be available to assist you.

We’ll contact you within a couple of hours to schedule a meeting to discuss your goals.

- PROJECT INQUIRIES info@artjoker.net

- CALL US +1 213 423 05 84

contact us: