The financial world isn’t just evolving — it’s being revolutionized. At the heart of this change is the use of generative AI in finance industry. According to McKinsey, AI could generate up to $1 trillion in additional value for global banking every year. Forward-thinking fintech startups and financial institutions are already experiencing faster loan approvals, sharper fraud detection, and hyper-personalized services thanks to AI solutions for finance.

Expert Opinion «The real power of AI isn’t in replacing people — it’s in amplifying what they can do. In fintech, it’s helping teams work smarter, faster, and deliver better services for clients.»Oleksandr Prokopiev CEO of Artjoker

In this article, you’ll discover:

- How the AI and finance industry is transforming today

- Real-world cases from Artjoker’s fintech projects

- Actionable ideas for integrating AI tools into your business now

Whether you're a startup founder, a product manager, CEO or CTO aiming to take your finance business to the next level with AI - this article is exactly what you need.

The Role of Generative AI in the Finance Sector

What exactly is generative AI? In short, it’s a type of AI that can generate content, analyze complex data, and make smart decisions — much like a human would. In the financial space, this means faster credit scoring, better fraud detection, and even AI-powered chatbots that can chat with your customers 24/7. This is one of the standout benefits of generative AI in fintech industry, where technology meets financial expertise.

The use cases of generative AI in financial services extend to predictive modeling, real-time analytics, automated reporting, and multilingual client support — prime examples of AI in financial technology making an operational difference.

Expert Opinion «The real power of AI isn’t in replacing people — it’s in amplifying what they can do.»Oleksandr Prokopiev CEO of Artjoker

Key Benefits of Generative AI in Financial Services

Why is the generative AI impact on financial services so important right now? Let’s make it clear:

Performance Wins:

- Automates things like credit checks, compliance reports, and data analysis.

- Spots fraud instantly with AI-powered anomaly detection.

- Improves customer experiences using AI chatbots and real-time financial advice.

Real Business Results:

- Cuts operational costs and reduces human errors.

- Boosts risk management accuracy and speeds up decision-making.

- Delivers faster, more personal service — essential in today’s competitive market.

These are the tangible advantages of AI in finance, showing how AI helps in finance by streamlining both backend and client-facing operations.

Curious how AI could scale your fintech product 3x faster? Book a free strategy session with our AI experts.

AI and ML Use in Banking and Financial Services Industry

The AI and ML use in banking and financial services industry has moved from experimental to essential. Financial institutions now rely on AI for:

- Predictive analytics in credit risk and portfolio management.

- Real-time fraud detection to catch suspicious transactions.

- Compliance automation to stay ahead of regulations.

- AI chatbots in banking for 24/7 support, loan applications, and account management.

These innovations represent the use of AI in banking and finance sector on a practical level and how AI to solve finance problems is becoming routine.

Real-World AI Use Cases in Finance

Artjoker has collaborated with fintech companies to harness the benefits of generative AI in financial services, delivering tangible results through innovative AI solutions for finance.

Expert Opinion «Clients love seeing direct results. AI isn’t just a buzzword for them — it’s about real numbers, faster processes, and happier customers.»Anna Avdieieva PM Unit Lead at Artjoker

Got intrigued? Read on to explore how we helped fintechs streamline onboarding, enhance fraud detection, and boost customer engagement with smart AI-powered solutions.

MyCredit (Ukraine)

Challenge: As a new entrant in Ukraine's emerging microfinance sector, MyCredit faced the challenge of developing an efficient online loan application and issuance process, including lender verification, secure data storage, and real-time customer communication.

Solution: Artjoker developed a comprehensive online lending platform incorporating AI-powered scoring and anti-fraud models — an ideal example of generative AI applications in finance. The system incorporated:

- Online application and instant issuance

- AI-based scoring and anti-fraud models

- Card linking and payment automation

- Secure user verification and data storage

- Scalable infrastructure for large volumes

Results: Within 5 months of implementation, MyCredit experienced a 73% increase in loan issuance and a 35% reduction in fraud attempts, showing how AI helps in finance to improve KPIs.

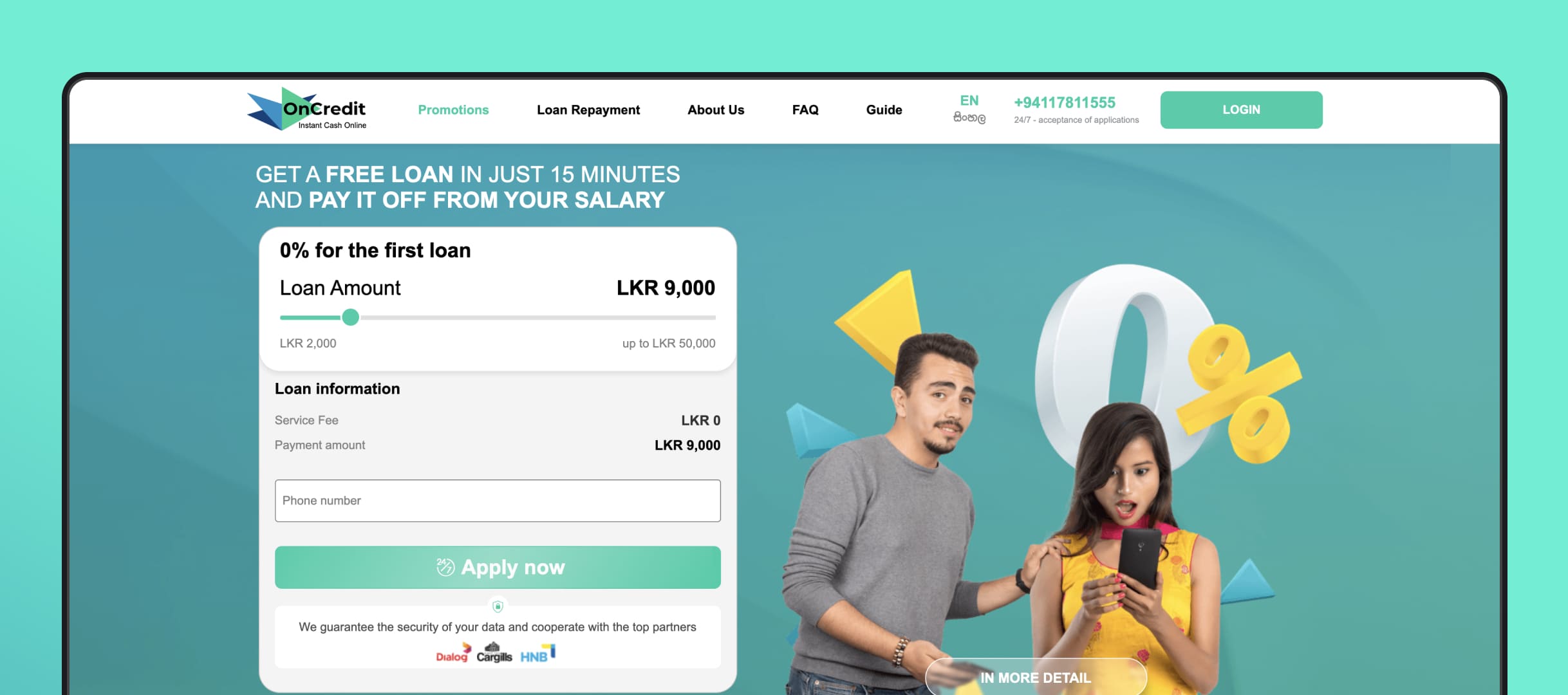

OnCredit (Vietnam)

Challenge: OnCredit aimed to establish a scalable online microfinance service in Vietnam, addressing the need for efficient loan application processing, lender verification, and integration with various external services.

Solution: Artjoker developed a robust platform featuring AI-powered verification systems and credit scoring, reflecting the growing role of AI in fintech. Other features include:

- Fast online loan application and issuance

- Integration with UBKI, Scorista, and payment services

- Automated notifications and debt collection

- AI-driven scoring and verification

- Scalable infrastructure with CPA network support

Results: The platform reduced loan application review time to 15 minutes, proving how AI for fintech delivers operational excellence.

SmartInvest (Ukraine)

Challenge: SmartInvest sought to provide clients with a convenient platform for buying securities, managing investment portfolios, and accessing educational resources to improve financial literacy.

Solution: Artjoker developed web and mobile applications featuring real-time market analytics and portfolio management tools — strong examples of AI in financial technology improving client engagement. Key features:

- User onboarding and Bank ID verification

- Investment portfolio management

- Real-time market tracking

- Educational content via the “University” section

- Secure asset and account management

Results: The application simplified the investment process, making it more accessible to retail investors and enhancing user engagement through educational content and intuitive interfaces.

These case studies illustrate how the use of AI in fintech leads to significant improvements in efficiency, customer satisfaction, and scalability for fintech software development services.

Want results like these? Here’s how our fintech software development services team gets it done.

AI in Fintech Startups: From Idea to Product Launch

The growing impact of AI in financial services is even more noticeable among fintech startups. Here’s why:

- AI speeds up prototyping and product launches.

- It builds scalable fraud prevention and credit scoring tools.

- It improves customer onboarding and retention with smart automation.

Artjoker has worked with startups like Lonvest, GoodDollar, Cryptoplatform etc., using AI to boost user acquisition, optimize risk management, and cut operational costs. These projects prove how AI isn’t just for big banks — it’s a startup’s best weapon for competing with established players.

See how gen AI is transforming financial services and helping fintech startups outpace the competition, explored in our fintech case studies.

What’s Next In 2025? The Future of AI and Automation in Financial Services

What’s coming next for AI in finance?

- Advanced chatbots in financial services offering 24/7 multilingual support.

- Generative AI for real-time reporting and financial analytics, further emphasizing the benefits of gen AI in finance.

- Hyper-personalized fintech apps delivering customized services to every user.

AI will continue to affect finance at every level, with AI managed services and DevOps services playing key roles in delivering scalable, secure, and resilient infrastructures for AI-powered systems.

Conclusion

The use of generative AI in finance industry is no longer just an innovation — it’s a must-have for businesses serious about competing in today’s market.

Generative AI is changing financial services at every level — from improving efficiency to helping you better connect with customers — and it's one of the most effective examples of AI for business today.

The importance of AI in finance is increasingly evident as companies turn to automation, intelligent analytics, and scalable platforms to gain a competitive advantage. And it’s not just for enterprise banks. Startups and growing fintechs are already using AI to outpace traditional players — cutting costs, speeding up operations, and delivering services clients actually want.

Want to build smarter, faster, and more secure fintech solutions? Book a free consultation — we’ll show you how AI makes it possible.

Similar articles

View allyour business

together

- PROJECT INQUIRIES info@artjoker.net

- CALL US +1 213 423 05 84

contact us: