Generative AI in Financial Services

The generative AI in financial services industry is redefining how banks, fintech companies, and investment firms operate. By automating complex processes, reducing risks, and improving customer experiences, generative artificial intelligence helps businesses stay competitive in a rapidly evolving market. At ARTJOKER, we specialize in generative AI for financial services and banking, creating solutions that enhance efficiency, ensure compliance, and unlock new revenue opportunities. Our approach combines innovation with reliability for measurable business impact.

Book a consultation now!

Maksym Kashcheiev

Head of Business Development

Benefits of Generative AI in FinTech

Generative artificial intelligence is not simply a fashion – it significantly transforms financial institutions and fintech companies. It offers important advantages to the generative AI in financial services market:

Enhanced Customer Experience

Chatbots powered by machine learning and virtual assistants enhance service quality, providing personalized support in real-time.

Operational Efficiency

By automating regular workflows, the need for manual work is minimized and tasks such as loan approvals and credit scoring are accelerated.

Advanced Fraud Detection

Generative models create synthetic transaction patterns to strengthen anti-fraud systems.

Regulatory Compliance

Artificial intelligence helps generate accurate compliance reports, reducing errors and audit risks.

Smarter Decision-Making

Predictive analytics and data-driven insights enable better financial planning and investment strategies.

Cost Optimization

Reduced operational costs through automation and improved accuracy.

Real-World Applications

There are numerous generative AI use cases in financial services, from algorithmic trading to personalized wealth management.

Gen AI in Financial Services: Implementation and Integration Process

Adopting gen AI in financial services requires a well-structured approach to ensure security, compliance, and performance. Our proven process guarantees smooth deployment and maximum business value at every stage.

Discovery & Planning

Define business objectives and identify high-impact generative AI use cases for financial services.

Data Preparation & Compliance

Secure and preprocess financial data while meeting regulatory standards.

Model Selection & Fine-Tuning

Choose the right architecture and optimize it for your needs to maximize the generative AI impact on financial services.

Integration with Systems

Embed artificial intelligence into existing banking and fintech platforms for seamless gen AI and financial services operations.

Testing & Validation

Conduct security, performance, and compliance checks before going live.

Deployment & Ongoing Optimization

Launch the solution and continuously improve accuracy and scalability for long-term success.

Generative AI Impact Across FinTech Stakeholders

Leveraging Gen artificial intelligence for enhanced financial services and operational efficiency.

- Invest in research and development

- Focus on risk management and customer service

- Partner with technology providers

- Improved operational efficiency

- Enhanced customer experience

- Reduced operational costs

Harnessing Gen artificial intelligence insights to drive strategic decision-making and innovation.

- Define strategic goals and artificial intelligence adoption roadmap

- Oversee implementation and deployment

- Use ML-driven analytics for business decisions

- Increased ROI on technology investments

- Accelerated innovation cycles

- Sustainable growth for the organization

Ensuring regulatory compliance and ethical artificial intelligence usage with smart tools.

- Verify all artificial intelligence solutions comply with regulations

- Implement automated compliance checks

- Monitor ethical artificial intelligence practices across workflows

- Minimized legal and compliance risks

- Lower reporting and audit costs

- Improved trust with regulators and stakeholders

Delivering personalized, accessible, and faster financial services powered by Gen artificial intelligence.

- Use ML-driven chatbots for 24/7 support

- Leverage personalized investment and loan recommendations

- Interact with secure, intuitive artificial intelligence platforms

- Enhanced customer satisfaction and engagement

- Faster decision-making with real-time insights

- More transparent and inclusive financial services

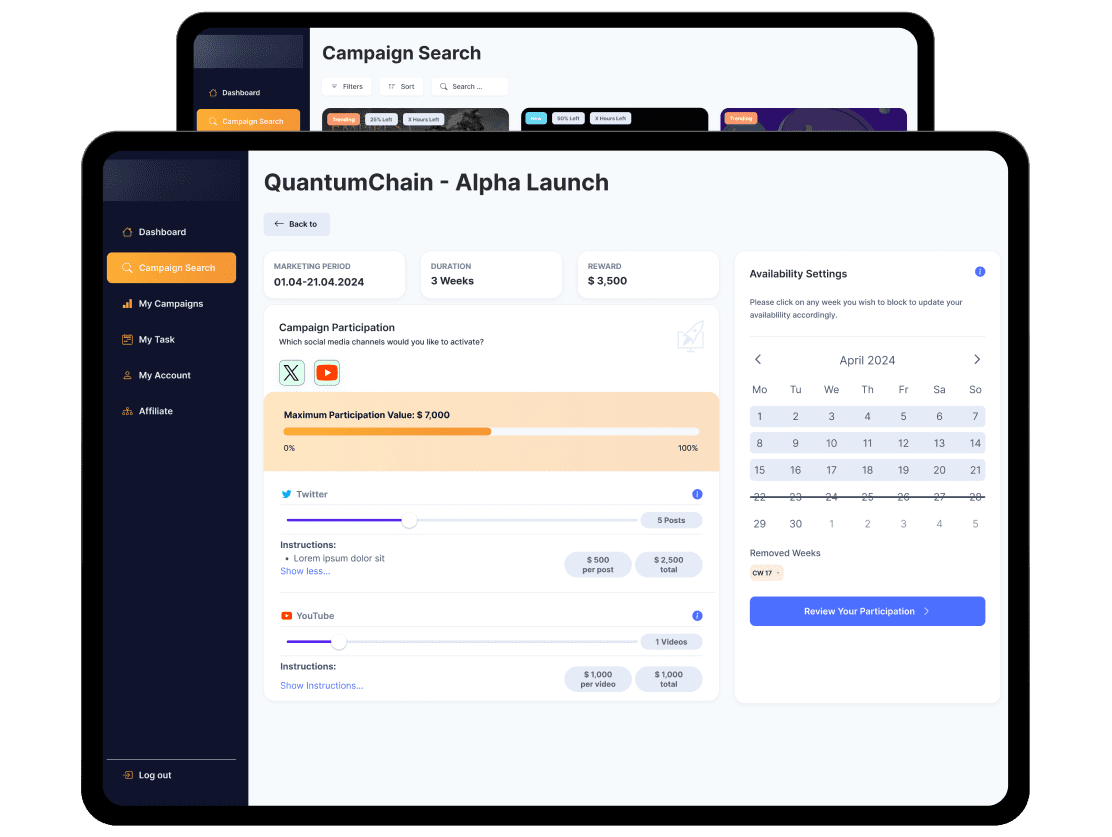

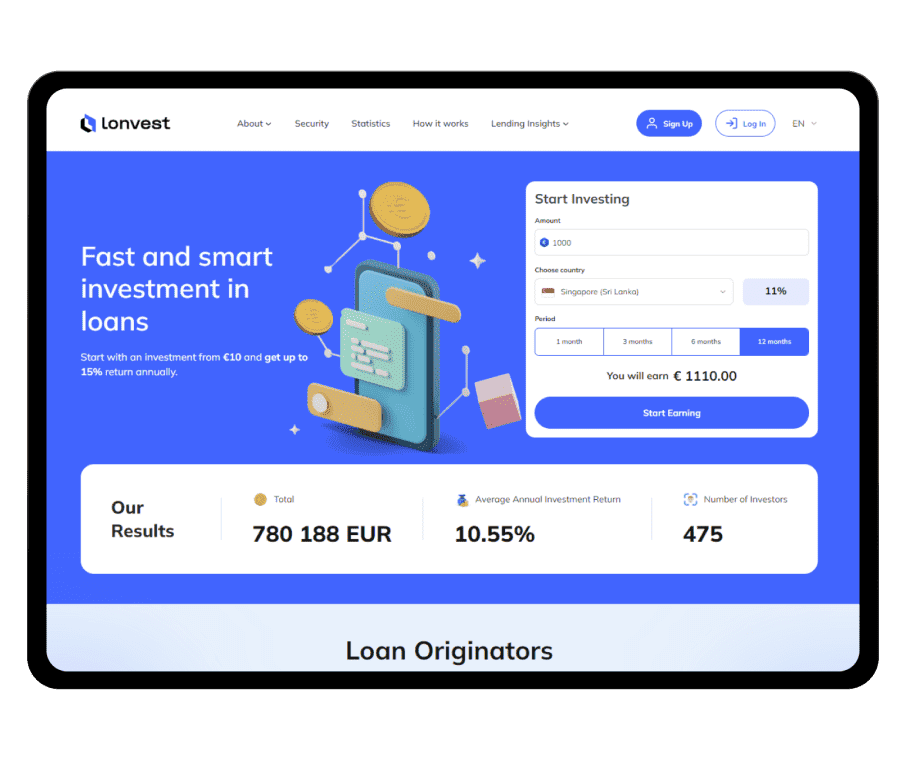

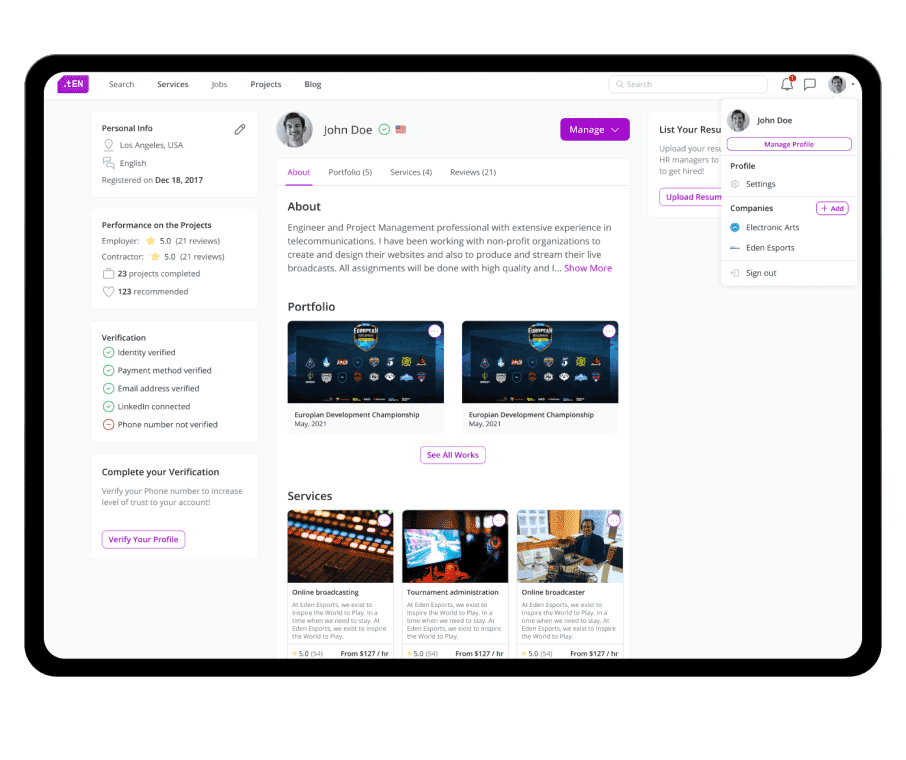

Custom Generative AI Solutions We Develop for the Finance and Banking Industry

At ARTJOKER, we deliver cutting-edge generative AI development services that empower banks, financial institutions, and fintech companies. Our team combines advanced technology with industry expertise to build AI solutions for finance that improve efficiency, enhance security, and personalize customer experiences. Here are our solutions:

AI chatbots for banking customer support

We create intelligent artificial intelligence chatbots that provide 24/7 assistance for customers, resolving queries, handling transactions, and delivering personalized banking advice. These solutions transform the way banks interact with clients, ensuring smooth fintech app development and seamless digital engagement.

Credit scoring automation

Traditional credit scoring can be slow and prone to inaccuracies. Our gen AI for financial services approach uses advanced models to analyze historical and alternative data, providing faster and more accurate risk assessments. This improves loan approval rates and enhances the customer experience.

Financial report generation

We develop ML-powered tools to automate the generation of financial statements, compliance documents, and audit reports. This reduces human errors and saves time while ensuring compliance with industry standards. It’s an essential part of software development for companies seeking accuracy and efficiency.

Tax calculation and filing assistants

Managing taxes can be complex, but with generative AI in financial service, we deliver smart assistants that calculate liabilities, optimize deductions, and generate ready-to-submit tax forms, reducing compliance risks and operational burdens.

Personalized investment recommendations

Our systems leverage artificial intelligence to provide tailored investment suggestions based on user profiles, risk tolerance, and market conditions. This feature is key for modern fintech app development, enabling firms to offer customers more value-driven insights.

Fraud detection and prevention systems

Fraud remains a major challenge for financial institutions. Our solutions use generative artificial intelligence to detect anomalies, simulate fraud scenarios, and predict risks before they escalate, ensuring secure and compliant solutions for finance.

AI-driven risk management tools

We design platforms that evaluate and predict potential risks using real-time data analytics. These tools help financial leaders make informed decisions and manage volatility across markets, a critical element in advanced development services.

Loan processing automation

Our ML-powered systems streamline the loan origination process – from document verification to credit risk scoring – reducing turnaround times and increasing approval accuracy. These solutions are crucial for banking app development and improving customer trust.

Algorithmic trading assistants

We create trading assistants that analyze market trends, process large datasets, and execute trades with precision. By using gen artificial intelligence for financial services, these systems enable smarter, faster, and more profitable trading strategies.

Financial forecasting platforms

Forecasting is essential for growth and stability. Our ML-driven platforms predict cash flows, market changes, and investment opportunities using real-time analytics. These advanced tools are at the core of next-generation fintech software development strategies.

Generative AI Use Cases in Financial Services

Generative artificial intelligence is no longer experimental – it’s driving real transformation across banking and fintech. From improving fraud detection to automating complex financial operations, businesses are already experiencing the benefits. Here are some practical examples of how our solutions create impact:

Gen AI Development Technologies We Use

Delivering enterprise-grade solutions for finance requires the right tools and frameworks. At ARTJOKER, we leverage advanced models, APIs, and infrastructure to ensure scalability, security, and top-tier performance. Here’s a look at the technologies that power our generative artificial intelligence solutions:

Language Models & Frameworks

Models

OpenAI (GPT-4, GPT-4o)

Anthropic Claude

Google Gemini

Meta LLaMA 3

Frameworks

Hugging Face Transformers

LangChain

LlamaIndex

API Access & Hosting

Providers

OpenAI API

Anthropic API

Google Vertex AI

Amazon Bedrock

Hugging Face Inference Endpoints

Together.ai

RAG (Retrieval-Augmented Generation) Tools

Frameworks

LangChain

LlamaIndex

Vector Databases

Pinecone

Weaviate

Qdrant

FAISS

Infrastructure & Deployment

Containerization & Orchestration

Docker

Kubernetes

MLOps / LLMOps

Weights & Biases

MLflow

BentoML

Hugging Face Hub

GPU Cloud

RunPod

CoreWeave

Lambda Labs

AI Agents & Chatbot Tools

Agent Frameworks

LangGraph

Autogen (by Microsoft)

CrewAI

UI for Prototypes

Gradio

Streamlit

Image, Video & Audio Generation

Image

Stable Diffusion (Stability AI)

Midjourney

DALL·E (OpenAI)

Video

Sora (OpenAI)

Runway ML

Audio

ElevenLabs

Whisper (speech-to-text by OpenAI)

Developer Tools

Coding Environments

VS Code

Jupyter / Google Colab

Prompt Engineering & Evaluation

PromptLayer

OpenAI Prompt Management

Guardrails AI

TruLens

Safety, Monitoring & Guardrails

Safety & Validation

NeMo Guardrails (NVIDIA)

Llama Guard (Meta)

Rebuff

HELM (Holistic Evaluation of Language Models)

Why choose ARTJOKER?

- Proven Industry ExpertiseYears of experience delivering ML-powered solutions for fintech, banking, and enterprise clients.

- End-to-End DevelopmentFrom strategy and consulting to deployment and optimization, we manage the entire process.

- Custom-Built SolutionsEvery product is designed to fit your business goals, not a one-size-fits-all approach.

- Regulatory ComplianceWe ensure all solutions meet strict financial regulations and data privacy standards.

- Cutting-Edge TechnologyWe use the latest generative artificial intelligence models, APIs, and MLOps tools for secure, scalable results.

- Agile and Transparent ProcessRegular updates, flexible engagement models, and full project visibility.

- Dedicated Expert Teamartificial intelligence engineers, data scientists, and domain specialists focused on your success.

Our Generative AI Experts

- Roman Katerynchyk Founder

- Oleksandr Prokopiev CEO

- Nataliia Brynza COO

- Maksym Kashcheiev Head of Business Development

- Anna Avdieieva PM Unit Lead

- Denys Nevedrov Business Analyst Unit Lead

FAQ’s about Gen AI and financial services

How can generative AI be applied in the financial industry?

Is generative AI compliant with financial regulations and data privacy laws (e.g., GDPR, FINRA, SEC)?

Can you develop custom generative AI solutions tailored to my fintech firm’s internal data and workflows?

What are the main risks of using generative AI in finance, and how do you mitigate them?

How secure is the use of generative AI when handling sensitive financial information?

Customers feedback

Our clients’ success stories speak louder than words. Businesses across banking, fintech, and financial services trust ARTJOKER to deliver innovative AI solutions that drive measurable results. Here’s what they say about working with us:

Our insights

Stay ahead of the curve with expert insights from our AI development team. Explore in-depth articles, industry trends, and actionable tips to understand how generative AI is transforming finance and beyond.

your business

together

- PROJECT INQUIRIES info@artjoker.net

- CALL US +1 213 423 05 84

contact us: